business analysis

Question 1: (10 pts.)

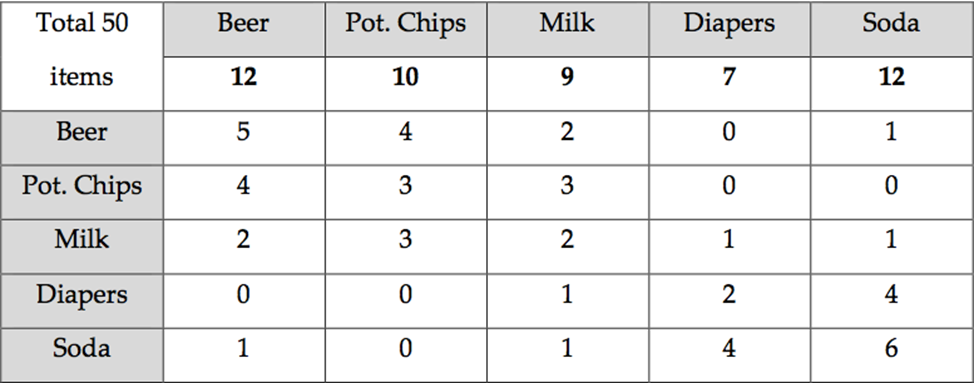

Below is a table of average sale information that a local small grocery store has collected from 4pm to 6pm on every Friday.

- Use Market Basket Analysis (Support, Confidence, and Lift) to compare two cases.

- Case 1: Consumer who bought potato chips also bought milk

Concerning support;

P(Pot. Chips) = 10/50, and P(Milk) = 9/50 totals 3/50 or 0.06

Confidence will be equal to;

P(Milk|Pot. Chips) = 3/10 or 0.3

Concerning lift;

Lift : P(Pot. Chips∩Milk)/P{(Pot. Chips).P(Milk)} = or 1.667

- Case 2: Consumer who bought soda also bought milk

Support : P(Soda) = 12/50, P(Milk) = 9/50 or 0.02

Confidence : P(Milk|Soda) = 1/12 or 0.0833

Lift : P(Soda∩Milk)/(P(Soda).P(Milk)) = or 0.4629

- What does the result in a) imply? Please interpret the results in a).

Basing on the Market Basket Analysis in section (1), there is a 0.06 probability that both potato chips and milk are bought by the same person together. Similarly, there is a 0.02 probability that soda and milk are bought together. The value of confidence checks the likelihood of a scenario to occur. For instance, there is a 0.3 probability that a person who buys milk had bought potato chips. In the same way, there is a 0.0833 probability that people who buy milk had bought soda. Both .3 and .0833 are confidence probabilities. Lastly, lift probability that when a customer buys one item, they will buy another. For instance, the probability that a customer buys milk increased by 67% if they bought potato chips and decreased by 54% if they bought soda.

- FAST HOMEWORK HELP

- HELP FROM TOP TUTORS

- ZERO PLAGIARISM

- NO AI USED

- SECURE PAYMENT SYSTEM

- PRIVACY GUARANTEED

- Based on the results in a), suggest a strategy which the store owner could implement to increase sales of milk.

The implication above shows that if the sale of potato chips increases, the sale of milk will also increase. Thus, store managers may place potato chips on a shelf adjacent to the milk freezers. Another strategy (confidence of product placement) would be placing milk far into the store, strategically that customers will pick the milk and come through a particular row, where potato chips are placed, and clear banners for them installed. The store may also come up with a promotion package, where a duo for milk and potato chips is discounted.

Question 2: (10 pts.)

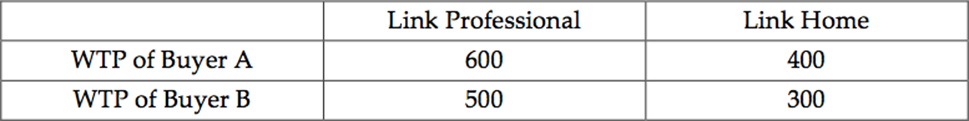

You are selling a software product called “Link” which is available in high- and low-quality versions called Link Professional and Link Home respectively. You have 2 units of Link Professional and 2 units of Link Home.

There are 2 potential customers, each of whom is interested in buying 1 unit of Link (either Link Professional or Home but not both). Suppose that your objective is to maximize the total revenue from selling the software. Further, you do not know the identity of either buyer and you must sell by posting one price for Link Professional and another price for Link Home. Each buyer seeks to maximize her consumer surplus and may buy Link Professional or Link Home or neither depending on the prices that you post. Please show all intermediate steps and clearly explain your reasoning.

- What is the optimal price and resulting revenue under the following scenario? What (if anything) would each customer buy?

The willingness to pay (WTP) is the maximum price for a business to value its products and charge a customer. The best price is often determined by finding the surplus from the highest and the lowest willing to pay. In this situation, we take Link home’s price as at least 400 and the price of Link professional be 500. Given that both buyer A and buyer B are willing to buy Link professionals at 500, the scenario allows revenue maximization to reach even 1000. In other words, 1000 is the maximum possible revenue that the WTP for buyers A and buyer B, since the price of Link Home is less than 500.

- If you could identify each buyer and make targeted offers, what price would you offer to each and how much revenue would you earn? What (if anything) would each customer buy?

As mentioned above, the best price is often determined by finding the surplus from the highest and the lowest willing to pay. Therefore, I would make a 600 offer to buyer A for Link Professional and an offer for 500 to buyer B for the same unit. The two high and low offers have a maximum revenue potential of 1100. Also, since we want to make a profit from the deal, it would be sold at a price higher than the WTP.

Scenario The willingness to pay (WTP) of the 2 potential buyers is:

Question 3: (10 pts.)

Read part of 2013 Macworld article about Appstore below to answer the following questions:

- Does Appstore provide a two-sided platform.? If yes, are there the same side and cross-side network effects? Please

Yes, the case reveals that Appstore provides a two-sided platform. In this case, the platform benefits both the customers (consumers of the Apps) and the App developers. Apps are inarguably very essential to run various mobile phone operations. Thus, the Appstore provides customers with numerous Apps, which are either free or premium (to be purchased). The App developer on the other hand, hopes that more customers can download their App, which increases their reputation. The more an app is downloaded, the more it appears to be valuable. Also, the more an app is downloaded, for instance, a premium one, the more revenue an app developer gets. Thus, the app user and the developer are dependent on one another, which leverages the Appstore’s cross-side network effect. The developer will depend on the customers to download more and build a reputation, while the customers will leverage the App’s utility. The developer will also rely on customers to earn revenue, while the app consumer will rely on the developer for future updates.

- Does Appstore operate in a market that exhibits “winner take all” dynamics?

Also, yes, the winner takes all. The Appstore operates in a market that exhibits “winner take all” dynamics. This is a situation where a business deliberately or otherwise creates a disruptive technology, which births a new monopolistic market. That is where Apple thrives on, as it is the largest in the app market, garnering the majority of the revenue with barely any competition. Consumers are charged for downloading some apps, yet they can only be found in the Appstore. It also thrives in the cross-side network effects due to the strong app developer-customer interdependency.

ORDER A CUSTOM ESSAY NOW

HIRE ESSAY TYPERS AND ENJOT EXCELLENT GRADES

The App Store turns five: A look back and forward

By Lex Friedman Jul 8, 2013

Five years ago, the App Store was born. A million apps, billions of dollars, and an uncountably high number of Angry Birds later, the store is unquestionably a smashing, unrivaled success. These days, customers download more than 800 apps every single second.

When the iPhone launched in 2007, Steve Jobs famously told developers that they could write “apps” for the device by creating Web apps. Developers mostly scoffed at that pronouncement

—some went so far as to jailbreak their phones just so they could play around with creating software for the revolutionary new device.

Respite came in March 2008, when Apple laid out the roadmap for iOS development—including a software development kit (SDK) for programmers to write their own apps—and announced that it would provide a storefront through which developers could sell their software.

The App Store launched on July 10, 2008, with a whopping 552 apps on its virtual shelves; the most common prices were $1 and $10, and there were a mere 135 free apps.

In the intervening years, the App Store has made some developers fabulously wealthy; gave some a new, stable career; and left others with broken dreams and disappointments. But owners of iOS devices didn’t focus on the App Store lottery—they simply cheered the many awesome new abilities their devices gained.

This is the story of the App Store’s success; it’s a success that has come in the face of plenty of issues with the store, many of which persist even to today. But more on that in a bit.

Not so humble beginnings

Among those 552 launch apps were many that still grace our home screens: MLB.com At Bat, Facebook, Yelp, Shazam, and Super Monkey Ball, to name a few. The App Store launched simultaneously in 62 countries; then, as now, it was accessible from a devoted iOS app, or as a feature sort of crammed into iTunes.

The App Store’s first weekend saw more than 10 million app downloads. Less than a month later, Sega’s Super Monkey Ball hit 300,000 downloads, netting Sega $3 million and Apple more than $1 million of its own, thanks to the store’s 70/30 revenue split.

By September, the store had surpassed 100 million downloads, and when the end of 2008 rolled around, the most downloaded App of the year, with 5 million downloads, was Facebook. Of course, since that particular App was (and remains) free of charge, those downloads didn’t translate directly into dollars for Facebook or Apple. But as the App Store’s fortunes rose, so too did the iPhone’s, and later the iPad’s. And Facebook’s mobile usage went through the roof.

This is a part of the article on MacWorld. You may read full article on The App Store turns five: A look back and forward.