SWOT Analysis

Although the device screens have dominated the display of graphics and other marketing communication materials, printing remains an essential aspect of marketing strategies. Printing is still applicable to packaging materials, envelopes, labels, and cardboards. However, competition in the market is high, depending on the target market that the business chooses (Guenther & Guenther, 2019). In that regard, this business will look for opportunities in the market that we can exploit to earn us great fortunes.

The company will continuously gather knowledge on different crafts and printing techniques to ensure that we fulfil our customer’s needs for products and services. After fulfilling the printing requirements for the full process, our consultants and graphic designers will strive to venture into stationery accessories and garment decorations. Through a company website that will be created, we will try to balance both national and local services. This is to ensure that we have a diversified customer base. Before printing is done, confirmations from customers are a must to enhance efficiency. Some of the products that we will deal in include the following;

- Patches

- Garments

- Invitations

- Monogrammed items

- Most other personalized items

At the start, one Embroidery machine is essential as it allows most of the work to be performed. Although this machine is expensive, it effectively facilitates the first phase of the company. Therefore, finding a shop in a strategic area in the city and a sound machine will start us off good.

SWOT Analysis

| Strengths Highly motivated and experienced workers High gross margins Online marketability of products A visible and fair market integrated website Low startup risk High barriers to entry | Opportunities Additional availability of capital Development of proprietary products Highly scalable business Affiliate relations with vendors High expansion of online sales Development of wholesale distribution rltns |

| Weaknesses High competition from established firms Limited startup costs High costs on logistics Inflexibility in pricing | Threats Products being sold cheaply by competitors High costs of insurance Changing regulations may affect business Higher costs may increase the pricing of items |

Strengths

One of our strengths is having highly motivated and experienced workers. My chosen business partner, who is my cousin, is experienced in the field for several years now. This will create a channel to a greater understanding of the existing problems and challenges.

Before the start of the business, we are planning to have a well-integrated website that is visible, customer-friendly, and easy to buy from, which will be enhanced through proper design and fair use of graphics.

The only physical items that the business will require are the shop and machine. These items are low risk considering that they one-time inventory and the machine is an asset in the business. However, and though a strength, the cost of renting a space in the city and buying the first machine is expensive. These high costs form a barrier to entry, which is beneficial to pre-existing businesses.

- FAST HOMEWORK HELP

- HELP FROM TOP TUTORS

- ZERO PLAGIARISM

- NO AI USED

- SECURE PAYMENT SYSTEM

- PRIVACY GUARANTEED

Weaknesses

In the printing business, there are already established businesses, which ensure that customers can be served at the lowest market price. Currently, the planned startup capital is not sufficient to cater for all the needs we have as a company. Thus, we may be forced to borrow a loan from a provider. Furthermore, a fair share of the capital will be used in the logistical element of the company.

Some of the items that are to be purchased are inflexible in pricing, which means that the company has to find an X amount of money to purchase. This is challenging, especially for us, considering the constraints of capital.

Opportunities

Although the company may experience constraints of capital, there are numerous opportunities in the United States where someone can access loans (Rodríguez-Priego & Palazzo, 2020). This means that capital may not be a problem at first before the business establishes itself. Wholesale distributions are a great way to sell prints in large quantities based on retailer requirements.

From the outlook, the business is scalable to a greater extent. Scaling the business allow earning more with little additional expenses and operational costs. Also, we can create an affiliate relationship with vendors, who will allow us to gain local market dominance in a short time.

Threats

Most products and services in the printing industry may be sold at a lower price by established brands considering they are selling at wholesale prices. These companies have the potential to cut these prices even further to ensure that their competitors remain submerged. Nevertheless, our market will depend on how competitive we will be and how fast we will establish our customers in the market. Additionally, the government may change regulations from time to time. This may cause significant changes in the industry, thus affecting our business.

Another threat is that the insurance charges may fluctuate from time to time. Considering all the aspects that we have to insure, this cost may be high.

Financial Plan

Our financial plan will be more dependent on finance growth and increasing of the customer base. In that regard, we will focus on creating demand through funding marketing efforts for the company. Some of the costs we will try to maintain at a minimum are the overhead costs.

Assumptions

We assume that sales will increase steadily

We assume that our long-term customer base will continue to grow

Through our strategic marketing efforts, we assume to have an influx of customers regularly

We assume that the printing industry will remain resilient over a more extended period.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current interest rate | 10% | 10% | 10% |

| Long-term interest rate | 8% | 8% | 8% |

| Tax rate | 30% | 30% | 30% |

| Other | 0 | 0 | 0 |

Break-even Analysis

ORDER A CUSTOM ESSAY NOW

HIRE ESSAY TYPERS AND ENJOT EXCELLENT GRADES

After the spending on set up and costs on an asset, the business will require a monthly revenue of $21907 to break-even. This is dependent on our monthly variable and fixed costs. Our fixed costs will be rent, labour, utilities, and insurance.

| PRO FORMA PROFIT AND LOSS | |||

| YEAR 1 | YEAR 2 | YEAR 3 | |

| Sales | 275,000 | 357,500 | 464,750 |

| Direct Cost of Sales | 151,250 | 196,625 | 255,613 |

| Other Production Expenses | 0 | 0 | 0 |

| TOTAL COST OF SALES | 151,250 | 196,625 | 255,613 |

| Gross Margin | 123,750 | 160,875 | 209,138 |

| Gross Margin % | 45.00% | 45.00% | 45.00% |

| Expenses | |||

| Payroll | 90,000 | 90,000 | 90,000 |

| Sales and Marketing and Other Expenses | 8,948 | 10,804 | 13,217 |

| Depreciation | 0 | 0 | 0 |

| Entertainment | 750 | 1,125 | 1,688 |

| Telephone/Fax | 1,800 | 1,800 | 1,800 |

| Liability Insurance | 600 | 600 | 600 |

| Rent | 0 | 0 | 0 |

| Payroll Taxes | 16,200 | 16,200 | 16,200 |

| Other | 0 | 0 | 0 |

| Total Operating Expenses | 118,298 | 120,529 | 123,504 |

| Profit Before Interest and Taxes | 5,453 | 40,346 | 85,633 |

| EBITDA | 5,453 | 40,346 | 85,633 |

| Interest Expense | 3,780 | 3,160 | 2,360 |

| Taxes Incurred | 502 | 11,156 | 24,982 |

| Net Profit | 1,171 | 26,030 | 58,291 |

| Net Profit/Sales | 0.43% | 7.28% | 12.54% |

Projected Cash Flow

Maintaining and growing the cash flow will require the business to focus on future developments. In that regard, cash flow and cash balance should increase with time from the start through to the future.

| PRO FORMA BALANCE SHEET | |||

| YEAR 1 | YEAR 2 | YEAR 3 | |

| Assets | |||

| Current Assets | |||

| Cash | 34,900 | 50,868 | 96,119 |

| Accounts Receivable | 23,600 | 30,680 | 39,884 |

| Other Current Assets | 0 | 0 | 0 |

| TOTAL CURRENT ASSETS | 58,500 | 81,548 | 136,003 |

| Long-term Assets | |||

| Long-term Assets | 0 | 0 | 0 |

| Accumulated Depreciation | 0 | 0 | 0 |

| TOTAL LONG-TERM ASSETS | 0 | 0 | 0 |

| TOTAL ASSETS | 58,500 | 81,548 | 136,003 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | 12,829 | 19,847 | 26,010 |

| Current Borrowing | 0 | 0 | 0 |

| Other Current Liabilities | 0 | 0 | 0 |

| SUBTOTAL CURRENT LIABILITIES | 12,829 | 19,847 | 26,010 |

| Long-term Liabilities | 44,500 | 34,500 | 24,500 |

| TOTAL LIABILITIES | 57,329 | 54,347 | 50,510 |

| Paid-in Capital | 43,000 | 43,000 | 43,000 |

| Retained Earnings | ( 43,000) | ( 41,829) | ( 15,799) |

| Earnings | 1,171 | 26,030 | 58,291 |

| TOTAL CAPITAL | 1,171 | 27,201 | 85,492 |

| TOTAL LIABILITIES AND CAPITAL | 58,500 | 81,548 | 136,003 |

| Net Worth | 1,171 | 27,201 | 85,492 |

| TOTAL LIABILITIES | 50,000 | 59,450 | 65,721 | 68,606 | 64,717 | 64,215 | 63,712 | 59,840 | 59,338 | 62,223 | 61,720 | 57,831 | 57,329 | |

| Paid-in Capital | 43,000 | 43,000 | 43,000 | 43,000 | 43,000 | 43,000 | 43,000 | 43,000 | 43,000 | 43,000 | 43,000 | 43,000 | 43,000 | |

| Retained Earnings | ( 43,000) | (43,000) | ( 43,000) | ( 43,000) | ( 43,000) | ( 43,000) | ( 43,000) | ( 43,000) | ( 43,000) | ( 43,000) | ( 43,000) | ( 43,000) | ( 43,000) | |

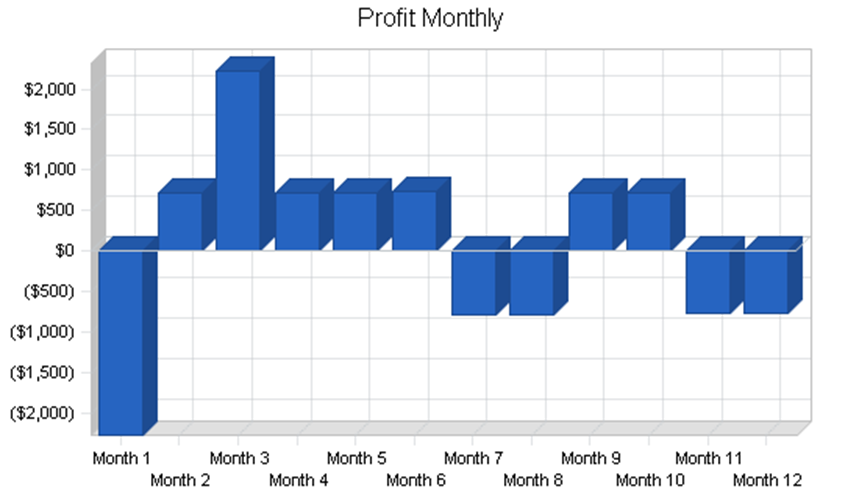

| Earnings | 0 | (2,276) | ( 1,556) | 662 | 1,385 | 2,112 | 2,840 | 2,057 | 1,277 | 1,995 | 2,715 | 1,942 | 1,171 | |

| TOTAL CAPITAL | 0 | (2,276) | ( 1,556) | 662 | 1,385 | 2,112 | 2,840 | 2,057 | 1,277 | 1,995 | 2,715 | 1,942 | 1,171 | |

| TOTAL LIABILITIES AND CAPITAL | 50,000 | 57,174 | 64,165 | 69,268 | 66,102 | 66,326 | 66,553 | 61,897 | 60,615 | 64,218 | 64,436 | 59,773 | 58,500 | |

| Net Worth | 0 | ( 2,276) | ( 1,556) | 662 | 1,385 | |||||||||

The startup money will be contributed 50%/50% with my business partner in the business where we will share obligations and profits.

According to the above financial breakdown, there is a higher possibility that I will enter into the business soon. The business shows accessible financial plans that any financer can use to fund us. The difference between the above financial records and the actual is the implementation process. In that regard, eliminating the assumptions to actual performance will guarantee the success of the company. The company will be registered as a limited liability company, which will reduce our tax burden. Most of the challenges we might deal with are maintaining a regular flow of customers, keeping up with the competition, and growing steadily. In the case we want to bring in an investor or investors, then we can agree on the sharing of company shares at any given moment.

Conclusion

The above analysis of the SWOT factors and the financial plan details the processes that the company need to take to enhance its customer base and to maintain a healthy financial portfolio. Therefore, having a financial advisor or a consultant is useful for the business to have approved financial plans. However, depending on the barriers of entry and the advice on loans and other funding sources, we will determine the timing that is convenient for us to venture into that business. Nevertheless, all these aspects of the business are subject to debate with the partner, and other parties that have power over us and our lives. In that regard, family advice and guidance will be sought after.

References

Guenther, M., & Guenther, P. (2019). The value of branding for B2B service firms—The shareholders’ perspective. Industrial Marketing Management, 78, 88-101.

Rodríguez-Priego, N., & Palazzo, M. (2020). Industrial Branding: Communicating in Business-to-Business Sector. In Beyond Multi-channel Marketing. Emerald Publishing Limited.