Starbucks Strategic Management

Starbucks is an American-based company, a premier roaster and retailer of specialty coffee globally, and one of the largest coffeehouses in the world. The company went through a series of crises in 2007 and 2008, leading to a significant drop in its market value and losing market share to Dunkin and McDonalds’ closest competitors (Koehn, McNamara, Khan, & Legris, 2014). This paper analyses Starbucks’ external and internal factors, competencies and strategic choices, organizational design, and strategic leadership.

External Analysis of the Starbucks Coffee Company Industry Environment

The external analysis of Starbucks Coffee Company explores the company’s competitive position in the industry and potential growth opportunities.

Starbucks Industry Overview

Starbucks competes in the retail coffee and snacks shop industry. In the 1980s, the coffee segment was small and undeveloped. That is the time Schultz acquired Starbucks. Things, however, began to change in the 1990s, stimulated Starbucks’ market success, linked primarily by the consumer interests developed by Starbucks’ success (Koehn, McNamara, Khan, & Legris, 2014). The industry players offering specialty coffee rose to 12,000 in 1999 from a more petite figure of 585 in 1988 (Koehn, McNamara, Khan, & Legris, 2014). Several factors triggered the coffee boom, including the growing interest in specialty food, organic food, and Arabica coffee, among others. Likewise, the per capita income was mainly rising among the affluent group. Coffee retailers responded rapidly to Starbucks’ achievement alongside the increased demand for specialty coffee, and by 2006, the U.S. had approximately 24,000 specialty coffee outlets. Caribou coffee was Starbucks’ most significant competitor in the Midwest, established in 1992, and managed about 500 stores by 2007, while Peet’s Coffee & Tea managed 136 states across different states by 2007 (Koehn, McNamara, Khan, & Legris, 2014). Several major competitors entered the market, with Dunkin’s Donuts introducing coffeehouse aesthetic 2006 as part of its stores to expand to West and South of the 15 000 united states outlets. MacDonald was another force, growing its coffee shops to 300 by 2001. However, Starbucks was still the industry leader as of 2007 at 36.7% market share, followed by Dunkin Brands at 24.6%, and other competitors McDonald’s Costa Coffee (Koehn, McNamara, Khan, & Legris, 2014).

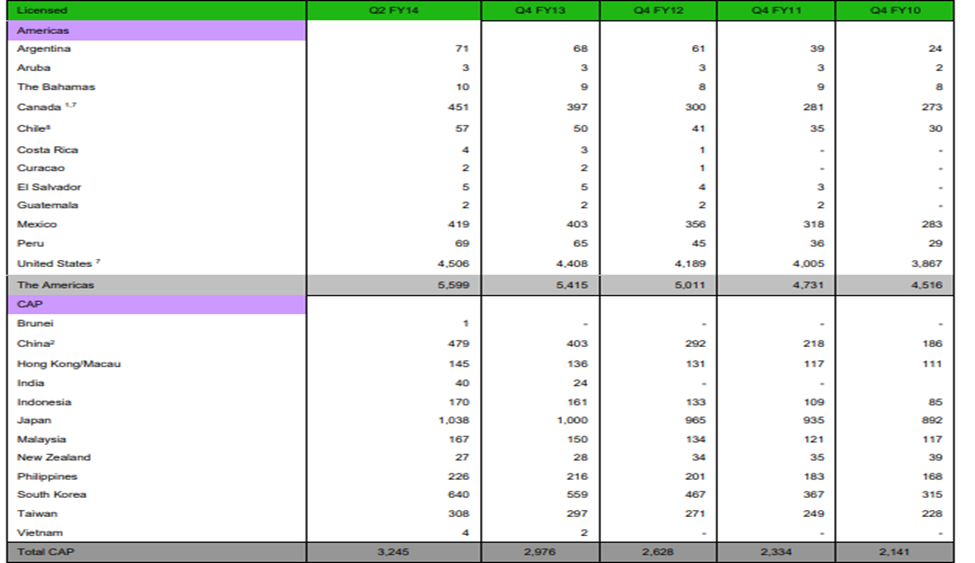

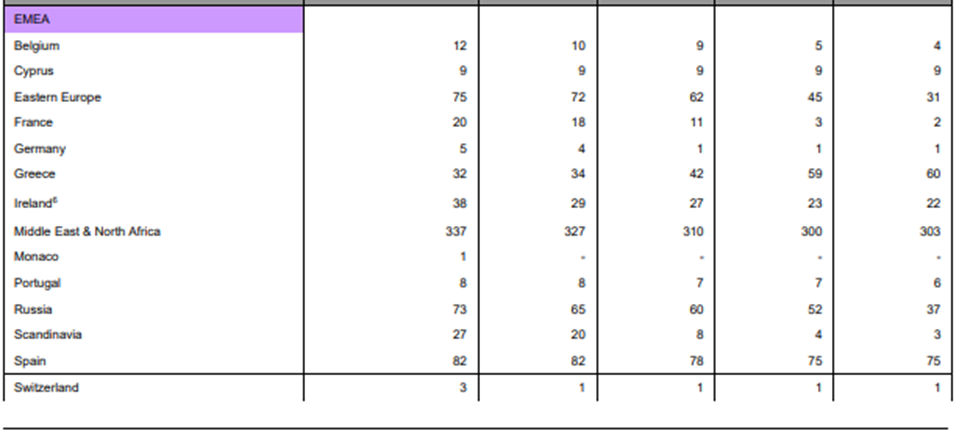

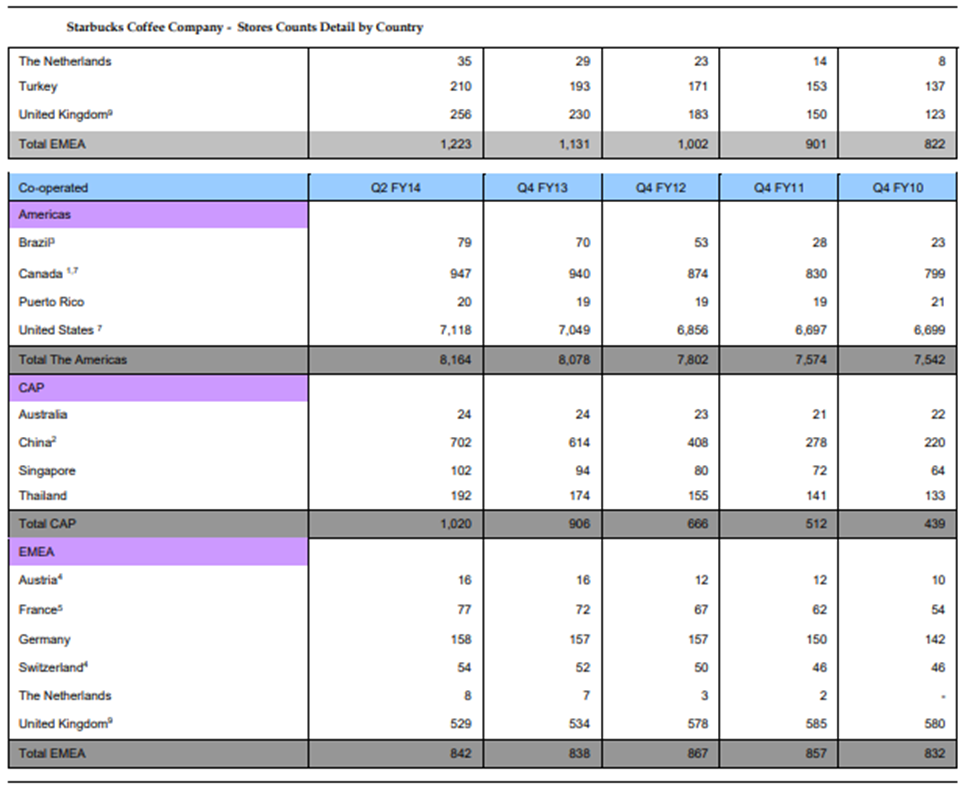

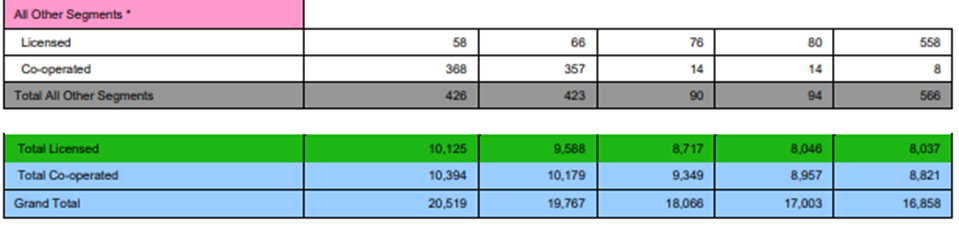

The coffee and store industry was hit by the economic crisis of 2007-2008 alongside changes in consumer tastes and preferences, which slowed down growth and financial performance, with the U.S. segment experiencing a 6.6% decline in revenue to $25.9 billion in 2009 (Koehn, McNamara, Khan, & Legris, 2014). Before the crisis, the industry witnessed a decade of consistent growth. However, because of the economic crash, consumers’ priorities shifted to spending less on luxury things like eating out and high-prince coffee and snacks and instead considered spending their income on low-priced essential items because of the dwindling budget. The industry again experienced a low annualized average growth rate of 0.9% between 2008 and 2013, hitting $29 billion in revenues, and projected growth of 3.9% to reach $35.1 billion in revenues in the U.S. market after five years, driven by improving economy and consumer confidence (Koehn, McNamara, Khan, & Legris, 2014). Globally, as of March 2014, the Asian Pacific and China were Starbucks’s fastest-growing markets, with revenues rising by 24% in just one year. India specifically offered an opportunity for expansion with increasing middle class alongside consumers’ interest testing new experiences coupled with global exposure. Globally, Starbucks manages 20,519 stores in 64 countries (Koehn, McNamara, Khan, & Legris, 2014), as shown in Appendix 1.

Porters Five Forces Analysis Starbucks Industry

The threat of New Entrants

The threat of new entrants is moderate, and barriers to market entry are not intense to limit competitors from entering the market. At the local level, smaller coffee stores can compete with Starbucks and other market giants such as Dunkin Brands since there is no switching cost on the side of the consumers. The threat of new entry played prominently between 1988 and 1999 when the number of specialty coffee shops rapidly grew from a mere 585 in 1988 to whooping 12,000 in the U.S. in just a decade (Koehn, McNamara, Khan, & Legris, 2014, p 4). However, the relatively moderate or easy market entry in the specialty coffee industry by large incumbent brands, including Starbucks, has attained significant economies of scale, a strong brand identity, and a considerable market share over the years. Starbucks and Dunkin Brands control more than 50% of the market, 36.7%, and 24.6% respectively, followed closely by McDonald’s and several other players, creating a sort of monopolistic competition (Koehn, McNamara, Khan, & Legris, 2014). Besides, large brands have differentiated themselves based on product quality, store ecosystems alongside and prime locations of the stores, large scale operations, which yield them a learning curve advantage, and effective supplier relationship build over time, which create relatively moderate barriers to market entry. Furthermore, it is expensive, and it takes time to develop a brand to the level of Starbucks, which lowers the peril replacement.

Threat of Substitute

The threat of substitutes is relatively high as there are substantial substitutes to coffee, including tea, fruit juice, and energy drinks. Pubs and bars with non-alcoholic and alcoholic beverages can also replace the social experience such as Starbucks. Furthermore, consumers can also make homemade coffee using household superior coffee makers at a smaller cost than Starbucks premium coffee. The low switching cost to other substitutes or lack of it altogether makes the threat of substitutes high. However, like other industry leaders, Starbucks is trying to counter the threat by retailing coffee makers’ finest coffee packs in grocery shops. Nevertheless, the threat still imposes significant pressure on Starbucks’ margins.

Bargaining Power of Buyers

Starbucks Company experiences the vital force of buyer bargaining power from different directions. Low switching costs is a critical force, along with the availability of substitute. Because of the low switching costs, buyers can quickly change from Starbucks to other brands. Furthermore, the high availability of substitutes implies that buyers can opt from other substitutes such as alternative beverages, other high-end consumers such as Dunkin, and several small and medium-sized coffee outlets. The substitutes outshined that private buying is more petite than Starbucks’ whole revenues. Dunkin’s Donuts was an alternative to Starbucks with its coffeehouse aesthetic introduced in 2006 to expand to West and South of the 15 000 united states outlets while Mcdonalds’ hit the 300th shop as of 2001, customers had varieties to select from at no switching cost (Koehn, McNamara, Khan, & Legris, 2014). However, Starbucks responded to the threat of substitutes through its vertically differentiated products with a diverse consumer base, making comparatively low volume buying, eroding the buyer’s power.

Supplier Bargaining Power

The supplier power in the industry is relatively low. Coffee beans and Arabica coffee, growing in selected regions, form the primary input of Starbucks’ value chain, implying that the cost of switching to an alternative supplier is low. Starbucks’ sales and size give it a higher bargaining power over suppliers. However, Starbucks has formed a partnership with its suppliers under the coffee and farmer equity (C.A.F.E) program, a sort of Fairtrade-certified coffee. The program offers customers fair partnership, which translates into lower bargaining power (Koehn, McNamara, Khan, & Legris, 2014). Starbucks’ enormous scope and size also mean large business for suppliers, lowering their bargaining power.

Internal Analysis of Starbucks Coffee Company

The organization over the years, despite having experienced financial crisis here and there, has been able to form a variety of products that are strategically differentiated to create a mix that serves their customers exceptionally well to give them not only a service but a Starbucks experience which is interpreted as effectiveness and efficiency at its best. A variety of premium products is not all because the company sees that it also provides its products with quality, which is denoted by aspects such as clean and well-organized stores, good communication skills, and the best community relationships, which helps build on loyalty and a cult following. This strategy has enabled the Corporation to build a strong relationship within itself, with the society it serves, the industry, the suppliers, and therefore attaining global recognition standards of a respected brand in the world. The Corporation uses the SWOT analysis model commonly applied by other organizations to re-strategize re-focus on track so that in the everyday activities, it serves its purpose to the letter. The model applied to the Corporation is as follows;

Strengths – These are factors that an organization achieves comfortably without any strain and are favorable to the organization at all times. The strengths that the Corporation has on its disposal and has been milking it over the years include:

- Human resource management- At Starbucks, the main asset is their employees. They see that they treat them well, promoting equality by providing equal opportunities and remuneration to foster growth and development and career satisfaction.

- Technology advancement- The Starbucks Corporation has its app supported in Apple and Android versions to improve customer experience by increasing efficiency and effectiveness.

- Strategic locations worldwide- Most of these organizations’ stores and branches worldwide are strategically located in areas that customers find convenient such as highways and urban places, which has been a plus to its industry position.

- It operates on goodwill- The Corporation has been keen on establishing good relationships by performing corporate responsibility tasks diligently and adequately, which helps significantly create a conducive environment for it to thrive in all its endeavors.

Weaknesses– These are factors that the Corporation struggles with and tries to improve every day. These factors at times might hinder proper performance, but the organization should ensure that it keeps swimming through. Some of the weaknesses that it has included:

- Stagnation – The Corporation At Times feels as if not making the right moves, especially regarding expansion because it is so concentrated in one region where it runs out of improving ideas. Stagnation is another explanation that can be caused by overdependence on the United States market because it operates so many stores meaning that in case of any hitch, Starbucks will face it rough.

- Expensive products – Starbucks deals particularly with differentiated products to give a variety and hence the famous experience associated with the Corporation. The processes are costly to put up and to combine for the customers. In financial crisis cases among customers, loyalty can be compromised because they will most likely opt for cheaper substitutes for Starbucks products.

- Culture clash – This mainly happens when other people’s cultures resist using a product. Like in this instance, the Starbucks products are not accepted in European countries as it is in America, and therefore, it widely affects the Corporation’s expansion strategy.

ORDER A CUSTOM ESSAY NOW

HIRE ESSAY TYPERS AND ENJOT EXCELLENT GRADES

Opportunities- These are external factors to an organization and give competitive advantages. Starbucks has the following opportunities:

- New markets – It captures new markets from expansion to new regions and areas, which increases returns and edge in the industry, which has happened in countries such as India.

- Starbucks has recently developed and integrated a mobile payment app, making the experience better to tap clients more effectively. These advancements in technologies are an opportunity that they are using to get a cult following from their clients, which reflects on the other side of returns.

- The Corporation has recently shown interest in a distribution channel called mobile pour to ensure that logistics are not an issue when it comes to serving the customer the experience that they particularly require.

- Starbucks has gotten an opportunity to expand its product mix by considering other products such as tea and juice, provided customer experience is attained.

Threats – These are factors that can easily cause damage, leading to an organization’s loss. Some dangers that Starbucks face includes:

- Increased competition with other market players such as Costa and Mc Donald’s ensures that it keeps on toes or is knocked out.

- Changing consumer tastes and cultural barriers can cause a shift from Starbucks products to those of other companies and, therefore, loss of sales and industry position.

- Price fluctuations in the world market that Starbuck can’t control can affect its performance because prices will skyrocket and hence be unable to maintain clients.

Starbucks also uses a V.R.I.O. analysis to understand its value standards and, most importantly, protect itself from outside attacks (Koehn, McNamara, Khan, & Legris, 2014). Apart from identifying what it is good at, it also needs to know how to protect it so that its competitiveness can last longer, which is when the V.R.I.O. strategy comes in. V.R.I.O. means that Starbucks corporation should strive to give clients products that add value to their lives in one way or another, seek to control a resource or a service that is rare to find meaning that customers will stay loyal, control products that are hard to rather cannot be imitated or in a better language do not have close substitutes to avoid cheap competition and most importantly, the organization should have a good structure in matters management, leadership and working teams for better realization of the organizations short term and long-term goals.

The Fit between Starbucks Coffee Company’s Competencies and Strategic Choices

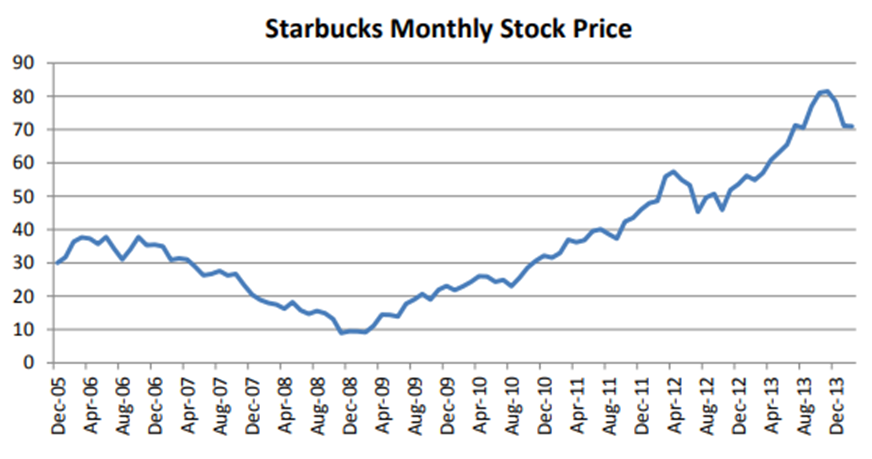

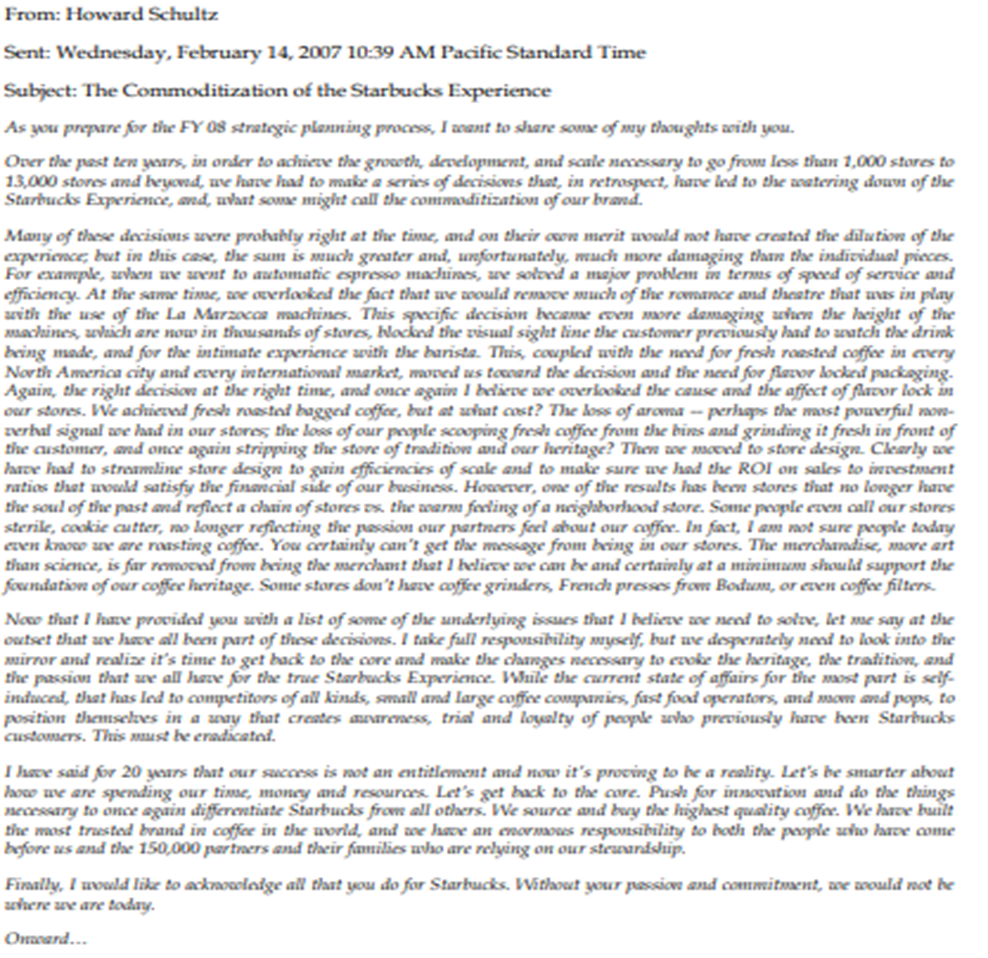

Starbucks’ rapid expansion shaken its core competency, the quality of its coffee. Starbucks expanded rapidly and introduced so many product lines that it could manage. Starbucks opened about five new shops weekly between 2007 and 2008 (Koehn, McNamara, Khan, & Legris, 2014). However, the speed of the growth did not match Starbucks. The company’s monthly stock and market value fell sharply between 2005 and 2008 as shown in Appendix 2 and Appendix 3, an indication that the rapid expansion negatively affected the company’s image (Koehn, McNamara, Khan, & Legris, 2014). For instance, training of the baristas was a challenge as more product lines implied more skills needed to make the coffee, and much training was necessary for Starbucks baristas. The rapid expansion in the number of stores and product line resulted in the downgrading of Starbucks’ training quality for its workforce, resulting in the decline of product quality. In an internal memo, Mr. Schultz also acknowledged that Starbucks’ expansion in the U.S. was too faster and recommended closing struggling stores and emphasizing overseas developments (Koehn, McNamara, Khan, & Legris, 2014).

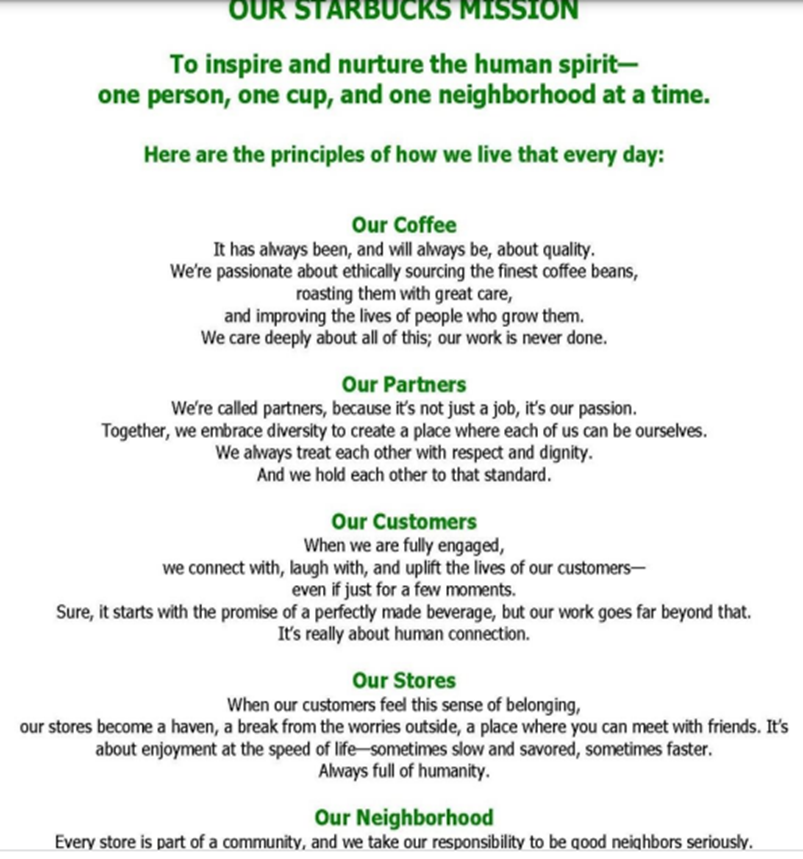

Other factors such as commoditization of the brand also impacted its brand image and customer experience. Mr. Schultz, in the internal memo, noted that most of the Starbucks crisis happened between 2007 and 2008 when the company introduced automatic coffee, which he argued impacted the brand’s “romance and theater” experience (Koehn, McNamara, Khan, & Legris, 2014). Even though the machine increased service speed, it significantly lowered customer experience, causing loss of aroma according to Mr. Schultz, and event contradicting Starbucks mission of “one person, one cup, one neighborhood at a time,” as shown in Appendix 4 of the company’s mission statement.

Analysis of the Starbucks Coffee Company Organizational Design

It operated in over 60 countries with more than 20,000 store outlets in Asia, the U.S., Middle East, Europe, and Africa, giving rise to a matrix organization design, a hybrid mixture comprising various features from the basic organizational structures, with a structural design that comprising of vertical and horizontal structure (Koehn, McNamara, Khan, & Legris, 2014). At the helm of Starbucks were the executives, consisting of the board of directors, the C.E.O. Mr. Schultz, and his team, while baristas at the lowest level, playing a vital role in connecting with the company’s customers. The lower-level employees, the barista, have the autonomy to serve customers in a manner that they deem best as Starbucks management acknowledges exemplary workforce performance and inspires them to cultivate hard and soft skills. This is echoed in Mr. Schultz’s memo Appendix 5 when he said that Starbucks baristas had lost the touch they had with the customers, and few of them seemed to remember the customers’ names and tell them the story of Starbucks offerings as it used to happen (Koehn, McNamara, Khan, & Legris, 2014, p.2). Starbucks had created an environment where middle-level managers and lower-level employees had the opportunity to serve customers at their best level without necessarily being supervised. This kind of autonomy given to the lower-level employees also created a flat organizational structure. The company also had geographic divisions managing over 60 countries it operated.

- FAST HOMEWORK HELP

- HELP FROM TOP TUTORS

- ZERO PLAGIARISM

- NO AI USED

- SECURE PAYMENT SYSTEM

- PRIVACY GUARANTEED

Alignment among the Elements of Organizational Design

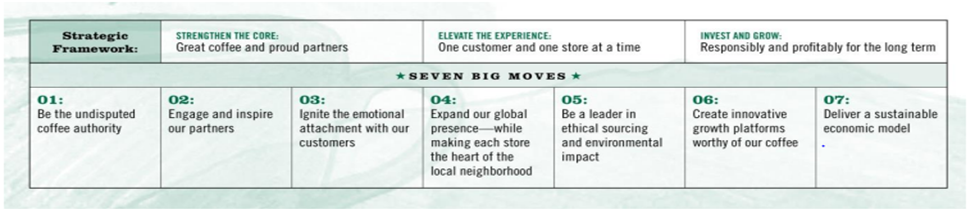

Each geographic division had senior executives given the flexibility to adapt the strategies to specific geographic divisions while maintaining the organization’s culture as defined by its mission statement, “one person, one cup, one neighborhood at a time” (Koehn, McNamara, Khan, & Legris, 2014). Starbucks also understands that good customer services are directly correlated to team performance, which drives Starbucks’ success in every location. This explains why Starbucks adopted an element of flat organization structure alongside his hierarchy model to allow baristas to interact effectively and service customers the way they deemed best. Teams empowered and motivated to perform in a manner that furthered their personal goals advanced Starbucks corporate culture, leading to accelerated growth before the crisis knocked in 2007 and 2008. In 2006, Starbucks revenues had hit US$7.8 billion, representing a 22% rise from the previous year. The net earnings increased by 14% to US$564 in the same period, more than 40 million visitors pushed through Starbucks doors, and the company expanded to over 12,400 store outlets globally, thanks to Starbucks coffee culture and motivated workforce to drive the culture (Koehn, McNamara, Khan, & Legris, 2014). Starbucks merchants told the story of the company’s offering, including them in the rituals of roasting and selling premium quality coffee (Koehn, McNamara, Khan, & Legris, 2014). All these seemed to have been lost by the rapid expansion, as Mr. Schultz’s noted in the memo that middle-level managers in all the Starbucks outlets he visited had lost touch with the company culture and were only interested in the margins, not customer experience, same to baristas as shown in Appendix 5. Starbucks prioritized engaging and inspiring partners to stimulate attachment with the customers in its “Starbucks Transformation Agenda,” as seen in Appendix 6.

An Analysis of the Strategic Leadership of the Starbucks Coffee Company

Strategic leadership prevailed in restoring Starbucks lost glory, where the management acted by setting direction, aligning, and motivating people towards the goal. 2007 and 2008 caused a significant impact on Starbucks’ brand image, leading to reduced customer experience and loss in market value, as seen in appendix 3. Hence, Mr. Schultz’s primary concern during the transformation of Starbucks was the restoration of the firm’s brand image and customer relationship. The need to restate the brand image and rebuild the customer relationship was vital for the company’s growth. Mr. Schultz launched the “My Starbucks Idea” campaign where customers’ concerns went straight to the headquarters, serving to collect customer views on improving Starbucks services and creating a sense of community among its customers (Koehn, McNamara, Khan, & Legris, 2014). The company began gaining trust among customers who felt they are part of a community from the campaign. And to Starbucks’, it got to understand its customers, consequently providing better services.

Starbucks’s leadership also rolled out several corporate social responsibilities (C.S.R.) initiatives under the slogan “Redefining the role of a for-profit company,” presenting itself as a community building and environmentally friendly company. Starbucks’ ethical sourcing and use of sustainable products reflected its environmental concern Appendix 6. The company sought to buy 100% ethically sourced coffee, partnering with farmers through Farmer Support Centers to increase productivity and sustainability, investing about $50 million to support farmers in its Global Farmer Fund Program (Koehn, McNamara, Khan, & Legris, 2014). Furthermore, Starbucks participated immensely in community building, including launching a store partnership model with Harlem and Los Angeles community organizations in 2011 (Koehn, McNamara, Khan, & Legris, 2014), boosting community education and employment. The new strategic leadership yielded fruit. Customers started gaining confidence in Starbucks, which saw its stocks and market value rising from 2009 onward, as shown in Appendix 2 and Appendix 3.

Appendices

Appendix 1. Starbucks Store Counts Details by Country

Appendix 2. Starbucks Monthly Stock 2005-2014

Appendix 3. Starbucks Market Value 2005-2014

Appendix 4. Starbucks Mission Statement

Appendix 5. Memo from Howard Schultz

Appendix 6. Starbucks Transformation Agenda

References

Koehn, N. F., McNamara, K., Khan, N. N., & Legris, E. (2014). Starbucks coffee company: Transformation and renewal. Harvard Business School Case, 314-068.