Professional Skills and Employability Development-Reflective Essay

Introduction and Background of the Essay

The ISO 31000/ISO Guide 73: 2009 defines risk as the “effect of uncertainty on objectives.” When organizations lack exposure or knowledge to specific events, such situations become uncertain (Dali and Lajtha, 2012, p 6). Decision-making around uncertain conditions or circumstances can either be successful or fails. That is what risk is in an organization entails. Risk can also be described as the uncertainty of future events, influencing its financial, operational, and strategic objectives. Today’s external and internal organisations’ environments present a more comprehensive range of risks, which affects an organisation’s financial, operations, and strategic goals, prompting the need for risk management and risk management strategies in the organisation. A formal risk management approach offers a structured method to highlight business objectives threats (Dali and Lajtha, 2012). As a Project Risk Manager, I will be analysing and assessing organizational project risks and identifying ways to reduce those risks when they come up. A critical eye is essential for this career path and making quick decisions based on my analysis. My interest is to become a project risk manager for a large retail store like Tesco Supermarket, competing globally.

The Reasons for Interest in Working as a Project Risk Manager for Tesco Supermarket

Project risk management entails identifying, analyzing, and responding to risks arising over the project’s life cycle. The goal is to ensure the project remains on track and satisfy the intended objective. Risk management is not just reactive measures but should also be part of the project management planning process to forecast the potential risks and manage risks if they occur. Risks are any event that could potentially influence your project’s timeline, budget, or performance. They are potentialities in the project management contexts and are classified as “issue” to must be addressed. As such, the primary responsibility of a risk manager, therefore, is to identify, categorize, prioritize, and plan for risks before they can turn into “issues.” The meaning of risk management varies depending on the projects’ type and magnitude (Tomanek and Juricek 2015, p18). For large-scale or massive projects, risk management techniques may include comprehensive, detailed planning for every potential risk and mitigation mechanism if issues arise. For small-scale projects, the risk management process may comprise a simple prioritized list of the low, medium, and high priority risks ((Tomanek and Juricek 2015, p19). My interest in working as a project risk management for retail companies such as Tesco is prompted by the need to be a change agent in the retail sector as a risk manager.

A simple retail distribution project comprises six core processes: buying goods from suppliers, sending the products to the distribution centre, transferring them to the stores, receiving cash, and banking receipts. Primary risks pose threats to these fundamental processes. “Tesco is about creating value for customers to earn their lifetime loyalty,” therefore, anything that poses a risk to its primary projects must be managed effectively. There is the realization, particularly in the retail sector, that risk management and associated strategies help create a competitive advantage, promoting an agile supply chain environment that operates better than ever before (Hoejmose, Roehrich, and Grosvold, 2014, p 81). Retail businesses that embrace risk management can outperform competitors and increase market share and customer base when a common risk strikes. Risk management also enables the company to minimize uncertainties, strengthening relationships, and trust with customers and suppliers (Schlegel and Trent 2014, p 32). Project risk management can continuously detect, optimize, and reduce risk exposures and associated costs.

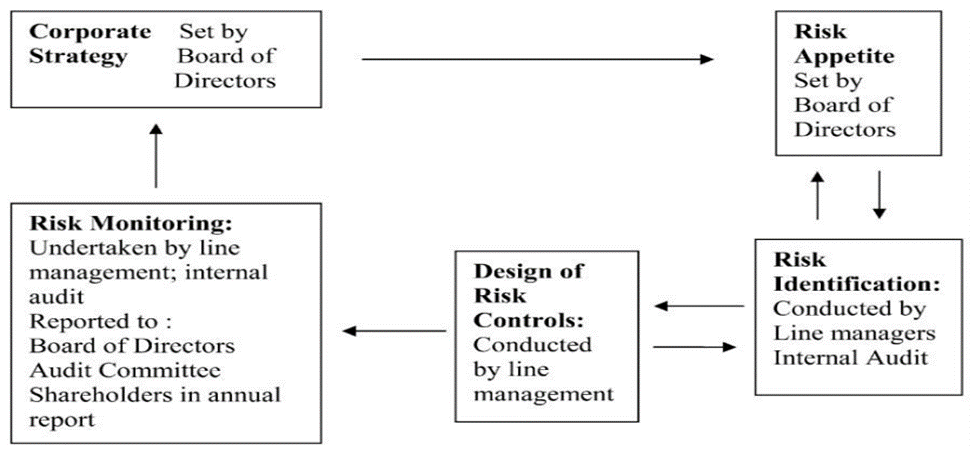

The idea that risk is inherent in any business operation is well established. However, the establishment and adoption of a formalised risk functions in the retail sector is a new phenomenon. The corporate governance practices established frameworks that aid in facilitating management accountability in the business environment characterised by separation of ownership from control, but such frameworks have failed to curtail the re-emergence of corporate scandals in many industries, including the retail sectors around the world (Cagliano, Grimaldi and Rafele, 2015, p 241). Regulatory institutions have reacted by introducing a mix of specific requirements and practice recommendations, emphasizing internal control’s significance to improve accountability and minimize risks of business failure. Such conditions and practice recommendations have raised the bar of enterprise risk management across organizations globally, with every business defining its risk management model depending on the operations (Cagliano, Grimaldi and Rafele, 2015, p 239). The risk management model for Tesco Company comprises of five significant processes as outlined in figure 1.

Figure 1: Risk Management Model for Tesco

Source: (Wood, Wrigley, and Coe, 2017).

Project risks for Tesco Company arise from a diverse range of factors of economic, natural, and social environments, and retail competitions. For instance, analysing competition risk, it is apparent that the retail industry deal in consumable goods and related activities, which include supermarkets, convenience stores, supermarket chains, specialty shops, and warehouse club stores. These chains of activities dealing in almost similar products generate forms of severe competition, which, when not appropriately analysed can cause a business to collapse (Hoejmose, Roehrich and Grosvold, 2014, p 79). Large retail companies such as Tesco Supermarket face aggravated competition from larger retailers such as Walmart and many others, and the corresponding surge in the retail enterprise, translating to operational risks. Other risks include the supplier risk caused by long-standing battles between suppliers and retail stores, alongside culture risks and internal information and communication disorder risks. The risks, however small or large, has a significant impact on retail operations (Revilla and Saenz, 2017, p 34).

Therefore, there is a need for continuous integrated detection, optimization, and reduced exposure risks and the associated costs. Project risk management in the retail environment entails establishing the risk of early warning and emergency handling systems to minimize risks. It is the risk manager’s responsibility in an organization to eliminate all forms of risks before the occurrence, and project the risk of loss degree (Revilla and Saenz, 2017, p 35). The initiatives are achievable by setting up a time to begin the contingency systems for emergencies and making warnings to avoid supply risks turning into severe consequences.

Key Employability and Leadership Skills

I have obtained my first degree in business administration and currently undertaking my master’s degree in risk management. During my studies, one of the skills acquired is the analytical skills and an eye for details, which I have obtained during my research, taking quantitative and analytical units such as business statistics, business mathematics.

I have also undertaken short certificate courses in finance and corporate risk management, to increase my understanding of risks in various markets and industries, including the retail sector. Besides, I have participated in leading risk assessment teams in the organization in a local store; I currently work part-time, where I have managed to learn some techniques and negotiation skills.

The knowledge and skills, alongside extensive reading on retail related risks, and having worked in a local supermarket as a risk lead after graduating with my first degree puts me in a better position to qualify for the risk manager post advertised by Tesco Supermarket. I have a vast understanding of the retail sector through my previous experience and studies as indicated above, which, combined with a degree and masters in risk manager qualifies me for the position.

Skills Gaps and How to Develop Them

I still have limited knowledge of supply chain risk, which I will improve by taking either an online or on-class short course alongside extensive research and risking improving my knowledge.

Employability/Career and Leadership Theories to Support Personal Reflections

A risk manager’s role and critical leadership responsibility are to formulate and communicate risk processes and policies for an organization. A project risk manager leads a team of cross-department experts in providing a hands-on development of risk models, including market, operational, financial, and credit risks. The risk manager also ensures that risk controls are operating correctly, providing research and analytical reports on the risk status. On that note, a project risk manager must have analytical and qualitative skills alongside the capability to apply the same skills to different business processes (Peng, Peng, and Chen, 2014, p 16).

- FAST HOMEWORK HELP

- HELP FROM TOP TUTORS

- ZERO PLAGIARISM

- NO AI USED

- SECURE PAYMENT SYSTEM

- PRIVACY GUARANTEED

Collaboration/Coordination and Teamwork

Risk management in a retail business such as Tesco Company is realized through collaboration and coordination with various stakeholders to ensure its continuity and realization of profitability. The risk manager’s role is to help identify risk concepts of the company’s operations by tracking risk drivers, defining the most common risk consequences, and mitigating project risks (Schlegel and Trent 2014, p 23). Most of these goals are achieved through team and collaboration, taking in and digesting every team member’s point of view.

Understanding the Market and Industry

The risk manager is required to understand the market and the industry where the business operates. An ideal risk manager is knowledgeable and comfortable with the company’s industry. By understanding the market and the industry where the business operates, the risk manager is better equipped to establish the posing risks (Lalonde & Boiral 2012, p 292). As for the retail industry, the risk manager must have a practical and theoretical understanding of the supplier risks, regulations, economic uncertainties, logistics risk, and overall supply risks.

The risk manager must also have a bit of financial insight. Retail risk management comprises of some degree of exposure to numerical figures, requiring a risk manager to be sharp at operating with financial tools as well as mastering the various economic indicators tied to the organization’s business lines, assets, markets, and regulations (Lalonde & Boiral 2012, p 282). The ability to endure and operate under pressure is another skill required of a supply chain risk manager owing to the pressures associated with the supply chain.

Technical and Communication Skills

A combination of technical and negotiation skills and lead teams’ ability is a vital leadership skill required of a successful retail supply chain risk managers. Combining the ability to participate effectively and lead people when managing technical issues is a rare skill and essential for success as a risk manager. The manager must learn to let people express themselves effectively in technical meetings, negotiating and influencing them towards a specific organizational goal. In addition to this, one must also have presentation and communication skills to effectively communicate and lead a change.

References

Cagliano, A.C., Grimaldi, S., and Rafele, C., 2015. Choosing project risk management techniques. A theoretical framework. Journal of risk research, 18(2), pp.232-248.

Dali, A., and Lajtha, C., 2012. ISO 31000 risk management—”The gold standard.” EDPACS, 45(5), pp.1-8.

Hoejmose, S.U., Roehrich, J.K., and Grosvold, J., 2014. Is doing more doing better? The relationship between responsible supply chain management and corporate reputation. Industrial Marketing Management, 43(1), pp.77-90.

Lalonde, C., & Boiral, O., 2012. Managing risks through ISO 31000: A critical analysis. Risk management, 14(4), 272-300.

Peng, M., Peng, Y., and Chen, H., 2014. Post-seismic supply chain risk management: A system dynamics disruption analysis approach for inventory and logistics planning. Computers & Operations Research, 42, pp.14-24.

Revilla, E., and Saenz, M.J., 2017. The impact of risk management on the frequency of supply chain disruptions. International Journal of Operations & Production Management.

Schlegel, G.L., and Trent, R.J., 2014. Supply chain risk management: An emerging discipline. CRC Press.

Tomanek, M. and Juricek, J., 2015. Project risk management model based on PRINCE2 and SCRUM frameworks. arXiv preprint arXiv:1502.03595.

Wood, S., Wrigley, N., and Coe, N.M., 2017. Capital discipline and financial market relations in retail globalization: insights from the case of Tesco plc. Journal of Economic Geography, 17(1), pp.31-57.

ORDER A CUSTOM ESSAY NOW

HIRE ESSAY TYPERS AND ENJOT EXCELLENT GRADES

Appendix 1: A copy of the job description

Appendix 2: A copy of the updated CV

CURRICULUM VITAE

XXX XXX

Date of Birth: xx/xx/XXXX

Mobile: xxxxxxx,

Nationality: United States

Email: xxxxxxx@gmail.com

I am an experienced and highly motivated Risk Manager with three years plus retail risks and issues management experience. I have a robust background in trading, retail policies and regulation, stores management, supply chain management, and finance. I am knowledgeable in using Microsoft Office, Excel, and PowerPoint. Besides, I have a strong understanding of risk control modeling and assessment, alongside analytical skills using risk methodologies.

PROFESSIONAL SKILLS

- Hand-on experience in organization risk management

- Sound knowledge in analytical skills and risk methodology

- Sound knowledge in financial analysis

- Sound negotiation and communication skills

WORK EXPERIENCE

Worked in ABC Company as market risk lead, January-September, 2019

Worked in XYZ Chain store a retail risk lead, September 2019-date

QUALIFICATIONS

Master’s Corporate Risk Management, xxx University, 2020-date

BBA (Hons) in Business Administration

Xxx University

Jan XX, XXX– Jan XX, 20XX

A-levels: Economics, English Language, Business Studies, and Mathematics.

XXX College

Jan XX, XXX– Jan XX, 20XX

GCSEs: 8 including Business Studies, Maths, Physics, Sociology, English—XXX School

Jan XX, XXX– Jan XX, 20XX

PROFESSIONAL QUALIFICATIONS

- Certificate in finance—January-April, 2018

- Certificate in Corporate risk management, September 2017-January 2018