Financial Analysis of Apple Company Inc.

Apple Inc. was established in Cupertino, California on April 1, 1976. The company was founded by Steve Jobs and Steve Wozniak. Apple is one of the largest American multinational corporations that design and manufacture consumer electronics and software. Some of its well-known products include Macintosh computers, the iPod, and the iPhone. The company faces stiff competition from other firms such as Dell Technologies, Super Micro Computer Inc., and Fit bit Inc. whose financial ratios can be used to show their performance in the industry.

Financial ratios are used to assess the financial health of a firm. Many ratios can be used but in this case, four ratios are examined. They include current ratio, net profit margin, return on equity (ROE), and return on investment (ROI).

| Current Ratio | Year 2019 | Year 2018 | Year 2017 |

| Apple Inc. | 1.5401 | 1.1329 | 1.2761 |

| Dell Technologies | 0.8036 | 0.8798 | 0.8069 |

| Super Micro Computer Inc. | 2.3463 | 1.8863 | 1.8753 |

| Fit bit Inc. | 1.4645 | 1.8235 | 1.974 |

| Profit Margin Ratio | Year 2019 | Year 2018 | Year 2017 |

| Apple Inc. | 21.2381 | 22.4142 | 21.0924 |

| Dell Technologies | -2.5491 | -3.6045 | -1.8773 |

| Super Micro Computer Inc. | 2.0546 | 1.3738 | 2.6904 |

| Fit bit Inc. | -22.3525 | -12.2904 | -17.1581 |

| Return On Equity (ROE) | Year 2019 | Year 2018 | Year 2017 |

| Apple Inc. | 61.0645 | 55.5601 | 36.0702 |

| Dell Technologies | 231.5287 | -16.7343 | -16.1713 |

| Super Micro Computer Inc. | 7.6413 | 5.472 | 8.6392 |

| Fit bit Inc. | -65.8189 | -25.2506 | -33.6413 |

| Return On Investment (ROI) | Year 2019 | Year 2018 | Year 2017 |

| Apple Inc. | 30.3113 | 29.6348 | 20.9082 |

| Dell Technologies | -4.5194 | -4.759 | -4.9525 |

| Super Micro Computer Inc. | 7.6413 | 5.472 | 8.6392 |

| Fit bit Inc. | -65.8189 | -25.2506 | -33.6413 |

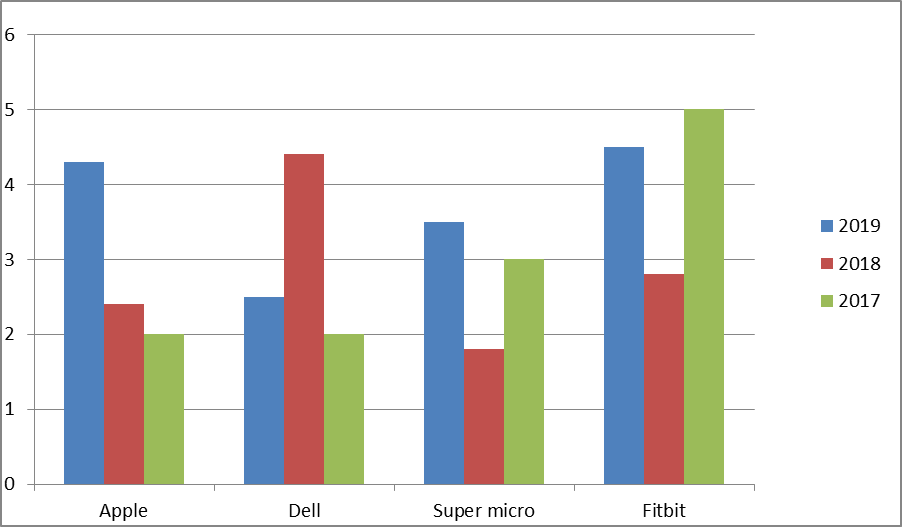

Current Ratio Analysis

The current ratio is a liquidity ratio that shows the firm’s ability to pay its short term liabilities. It shows the investor if the firm can maximize its current assets to settle the debts that fall due within one year. On the other hand, the net profit margin is a ratio that shows how each dollar of revenue collected by the firm translates into profit. Both ratios are used to assess the firm’s ability to make profits from its operations and remaining safe from its creditors’ claims. Out of the four competing firms, Apple has the highest net profit margin ratio. It means Apple makes the highest profit in the industry compared to its competitors.

Return on equity is obtained by dividing the net income by shareholders’ equity. The ratio measures how the management can utilize the firm’s assets to generate profit. Return on investment measures the efficiency of a particular investment compared to other available options (Willy 45). The ratio is used to determine the return that investment can bring to the firm. The two ratios are important to investors and shareholders because they show how the management is utilizing the firm’s resources to increase the wealth of shareholders. A firm that can invest in profitable investments will have the value of its shares going up in the stock market. From the ROE and ROI analysis, Apple Inc. tops in the industry and therefore investors can be advised to buy more shares from Apple Inc.

In summary, Apple Inc. is doing much better compared to its competitors. From the ratio analysis, its current ratio stands at 1.5 which means the firm is able to pay all its creditors. A firm that is not able to pay its creditors faces a risk of bankruptcy and is not favorable for investors. Both return on equity and return on investment ratios for Apple Inc. are good enough to give the shareholders an assurance that the management is using the firms resources to maximize the shareholders’ wealth; which is the priority interest for shareholders. My advice to any investor currently holding shares for Apple Inc. will be to purchase more shares since the value per share keeps on going up. Increase in share value is a benefit to the investor and there is a reason to acquire more shares whenever possible.

Works Cited

Willy, Siska. “Analysis of financial ratios to measure the company’s performance in the sectors of consumer goods at Pt. Nippon Indosari Corpindo, Tbk and Pt. Mayora Indah, Tbk.” International Journal of Business and Economic Affairs 2.1 (2017): 45-51.