Apple Mac OS Market Domain

Political

Apple relies significantly rely on the low-cost production in China, and any political decision or tension can affect its production and market for its Apple Mac OS in China. The joining of China to the World Trade Organization in 2001 created a threat and opportunity for Apple Inc. Reducing the market and investment barriers allowed the company to take advantage of Chinese low labor costs and a potential opening for the market. Apple responded to the political changes by shifting a fraction of its production plant to the Chinese market to become more efficient. Besides, Apple also received a significant fraction of its sales for Apple Mac OS and other products from outside the U.S. The company’s overall global sales income was about $113.8 billion compared to $68.8 billion from the United States (Iqbal, Rahman, & Elimimian, 2019). Any political disturbances and bad international relations from in the operating countries may affect sales, as witnessed during the Trump administration that affected U.S. relations with China. Any adverse relationship between China and U.S. in case Trump in case gets reelected may force Apple to pay for the two nations’ political differences; for instance, raising the minimum wage by the Chinese government would increase production cost for Apple (Iqbal, Rahman, & Elimimian, 2019).

- FAST HOMEWORK HELP

- HELP FROM TOP TUTORS

- ZERO PLAGIARISM

- NO AI USED

- SECURE PAYMENT SYSTEM

- PRIVACY GUARANTEED

Economic

External economic factors present both opportunities and threats for Apple. Economic stabilities in developed nations create offer opportunities for the expansion of Apple Company. Likewise, rapid economic growth in developing countries, particularly the Asian nations, is an opening for Apple Inc. to increase sales and revenues through sales in such markets. Higher disposable income in developed and developing countries creates more opportunities to sell Apple’s relatively high-priced Mac OS and associated technology products such as PCs. There is also fear that China may increase the minimum wage in the future, increasing production costs and loss in profits. An increase in competition is also affecting Apple’s Mac OS as the company has considerably lost market share to other brands such as Samsung, Dell, and Lenovo PCs and Linux OSs, which is the most preferred in China and Windows in U.S. (Khan, Alam, & Alam, 2015).

Social

In terms of social factors, the projected potential growth in consumer spending in the coming years in developing countries in Africa and Asia is a call for Apple to market its products to such areas. However, many people in developing worlds in Africa are still unfamiliar with Apple as most of its products are premium-priced. The Chinese market, where Apple produces a significant fraction of its products, seems to be a favorable market owing to its high population, which offers huge access to the market. People are embracing technology very fast and open to innovative services and products. Both the young and the olds have the disposable income to afford premium-priced Apple products. However, the Chinese are extremely conscious about prices, affecting the sales of Apple products in such markets.

Technological

The advancement in technology has also proven favorable to Apple smartphones but hurts the sale of Mac OS. In the Asian markets, Google chrome and other alternatives OSs such as Linux and Windows are preferred since they offer similar features as Apple products but at lower prices and readily accessible.

ORDER A CUSTOM ESSAY NOW

HIRE ESSAY TYPERS AND ENJOT EXCELLENT GRADES

2. Prioritized List

Political

Producing several products and parts outside the U.S., in China, Korea, Czech Republic, and Korea, Apple’s sales may have unpleasant outcomes as the rate of its success is always pegged on political relations between U.S. and these countries. Apple’s new generation products, including the Mac Pro and O.S., should be produced in the United States to avoid facing tariff threats between the United States and China. Besides avoiding tariff and important duties, the value for producing Apple Mac OS and computers in the United States using parts sourced from suppliers and manufacturers across the U.S., Arizona, and New York, Texas. New Mexico, and Maine, will increase the value of the products, stimulate local attachment and ultimately sales among the U.S. people. For instance, Eli Blumenthal noted that “the value of American-made components in the new Mac Pro is 2.5 times greater than in Apple’s previous generation Mac Pro” (Blumenthal 2019). Apple should start to focus on local production to evade trade war between U.S. and China and the fact that the Chinese economy is also growing rapidly and may soon shift to the consumption of most of their locally-made technologies relatively such as Linux OSs.

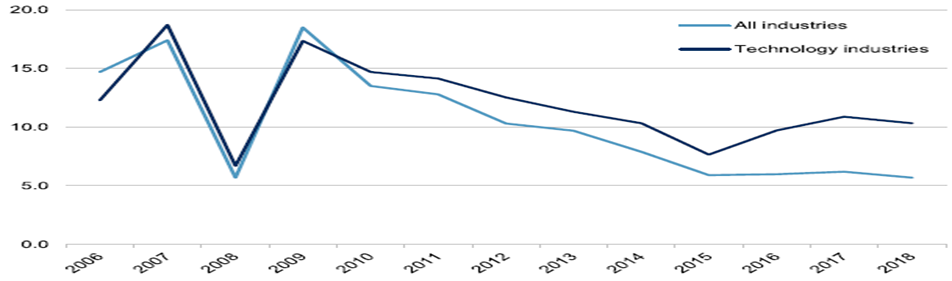

The rapid growth in Chinese technology in every aspect, in-company equipment, or consumer products to manufacturing poses a threat to Apple products such as Mac OS, which might completely be pushed out of the Chinese market with time. The Chinese technology industry has outgrown other industries, as shown in figure 1.

Figure 1: China Technology Industry vs. Other Industries

Source: (S&P Global, 2020).

Economic

Apple’s products are of premium prices, meant for higher-end markets. This explains why the company has not penetrated the Indian market deep, which is presently dominated by Samsung. However, the study shows that emerging African and Asian economies present significant openings to global business expansion in distribution and retail. The demographic changes and improving business environments in developing economies are projected to translate into more middle and upper-class people by 2030, with an increased appetite for technology consumption. Apple should consider marketing and producing products that target such developing markets to increase revenue and sales in the future. Most developed markets such as China, Korea, Germany, France, and many others are coming up with their technologies, which will soon block Apple’s highly-priced products (Khan, Alam, & Alam, 2015).

Social

Apple’s brand is friendlier to consumers’ lifestyles in developed countries who are not price-conscious, something that the company should work on to remain sustainable with the rapidly evolving technology world. Large markets with disposable incomes such as China finds Apple product relatively unattractive because of price consciousness. The Chinese market has witnessed a rise in P.C.s and smartphone firms, including Lenovo worth US$ 51.04 billion in 2018 and Xiaomi at US$ 24.44 billion in 2018, among others, which compete with Apple products because of low prices. In other populous markets such as India, Apple has low popularity and brand image, which has seen it lose market share to H.P. and Lenovo for P.C. sales (S&P Global 2020). It’s time apple consider diversifying into relatively low-priced products.

Technology

Apple should take advantage of the increased technology integration to improve the company’s services and expand its business operation by offering technology products to more customers, including other companies. It is essential to reinforce Apple’s business capabilities, exploiting every opportunity presented by technology to protect the company from competitive threats (Khan, Alam, & Alam, 2015). This should include diversification to other technical services such as cloud services and producing relatively low-priced products to attract developing economies.

3. Readiness

The Apple Mac OS may not be as competitive as windows in the United States and Linux most preferred by the Chinese government, the two largest markets for technology products. The perception that most of the Apple technology products are premium-priced could explain the reason for low demand in the Apple Mac OS. The rapid advancement in Chinese technology, where Apple produces and targets to sell most of its products, is to the company’s disadvantage as Chinese-developed OS such as Linux is coming up very fast and much preferred in the China market. Apple PCs also do sell much in other countries outside U.S. However, Apple holds its district place in other products such as watches and iPhone (Garg 2020), which have seen its valuation reach $1 trillion in 2018, and should inform its market focus.

References

Blumenthal (2019). Apple’s Mac Pro manufacturing will stay in the U.S., thanks in part to tariff reprieve. https://www.cnet.com/news/after-federal-break-apple-will-keep-mac-pro-made-in-the-usa/

Garg, P. (2020). How has Apple gained a competitive edge over the years? Medium. https://medium.com/macoclock/how-has-apple-gained-competitive-edge-over-the-years-aff0a259de0d

Iqbal, B. A., Rahman, N., & Elimimian, J. (2019). The future of global trade in the presence of the Sino-US trade war. Economic and Political Studies, 7(2), 217-231.

Khan, U. A., Alam, M. N., & Alam, S. (2015). A critical analysis of the internal and external environment of Apple Inc. International Journal of Economics, Commerce and Management, 3(6), 955-961.

S&P Global (2020). A New Great Game—China, the U.S., and Technology. https://www.spglobal.com/en/research-insights/featured/a-new-great-game-china-the-u-s-and-technology